Goal: Retirement Plan, Savings for future life

My investment goal seems to be fulfilled gradually, My money is getting invested in the right funds.

I like the fact that I get a Super-fast response.

Having a mobile app in future to track my investment would be helpful

Portfolio Management Service (PMS) is a professional financial service, that manages your financial portfolios. Our trained portfolio managers and stock market experts manage your investment portfolio with the help of the research team. Investment adviser licenses are required for portfolio managers in each jurisdiction. The only time a portfolio manager is permitted to handle a client’s assets is when the client has given their written consent to this action.

To make wise investment decisions, portfolio managers are frequently connected to an investment firm that can give them access to additional market data, such as news releases and earnings reports.

Portfolio management services offer personalized investment strategies based on your individual goals, risk tolerance, and time horizon, which is the primary distinction between portfolio management services and traditional investment management.

To assist you in making wise financial decisions, it also provides unbiased research on stocks, bonds, and other products

The services offered by portfolio management include:

Premium Portfolio Management Services for High Net-worth Investors

Types of Portfolio Management Services

Active Portfolio

Management

Entails routinely and actively monitoring the performance of a single fund. For instance, it might calculate the percentage change in an individual stock’s value over time or assess how this fund’s performance compares to other funds in the same sector of the market.

Passive Portfolio

Management

Entails keeping track of the performance of the entire portfolio rather than just one particular fund. For instance, passive portfolio managers may keep track of both the inflow and outflow of cash from their clients’ mutual funds when those clients sell shares.

Discretionary Portfolio Management

It is the process of managing investments following a set of guidelines established by a financial advisor as opposed to strictly adhering to buy/sell processes. The regulations could specify when to purchase and sell stocks, bonds, or other securities as well as when to start new investments or modify current ones.

Non-Discretionary Portfolio Management

It is a type of program that lets you set guidelines for how much money should be allocated to each asset class, but it forbids you from changing those rules at any time.

Our numbers speaks for themselves

40 to 248 Cr (AUM) in 2 Years

443 Satisfied Customers

97.36% Client Retention Rate

13-15% XIRR Mutual Fund

17-20% Demat Account Handling

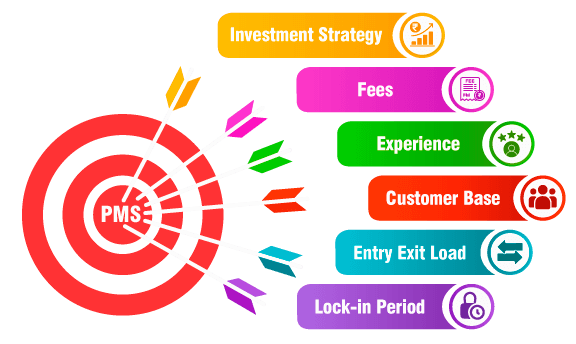

How do we differentiate ourselves

What our client Say?

Investment Goal: Retirement Planning

A trustworthy and competent group of financial advisors. Provides professional advice on how to manage and grow one’s money.

Goal: Creating wealth for early retirement

Mrs Komal understands the customer needs and based on her experience she suggested good investment options. I am very happy to see my investment portfolio on the track.

Goal: My kid’s education

Initially, I had no idea how to plan my investments and achieve my goals. After meeting with Mrs Komal Thakur from The Gainers, clarity dawned.

I feel happy to see my investments perform well and march towards the target.

It’s almost back from 3 years I am connected to the PMS team of The Gainers, and the growth towards my financial goals are outstanding .Their contribution and advice while planning a complete structured process of achieving my financial goals has given me a complete relief from such a tedious work.

For more than 5 years, I have been connected to The Gainers Portfolio Management Service. I’m glad they working smoothly their client’ risk tolerance and financial objectives and offer investment advice in line with those understandings. My capital has increased significantly over time thanks to the PMS team’s portfolio management, and I look forward to keeping up a long-term partnership with The Gainers

I’ve recently begun structuring my investing and tying it to particular objectives for the first time. The finest aspect is working with a committed financial advisor who has spent many hours getting to know me and my long-term objectives.

Portfolio management services are specialized services that professional wealth managers offer. Their goal is to build a financial portfolio for the client that includes stocks, bonds, cash, and other assets.

- Strong industry network

- Best wealth management and financial advisory solutions

- Focus on financial and strategic objectives superior execution

- Strong investment policy framework thorough due diligence approach

- Emphasis on choosing future winners tailored offerings.

What Are the Charges of Portfolio Management Services?

The response varies based on your portfolio’s size, the portfolio manager’s experience, and the services they offer. However, you should budget 1% to 2% of your assets under management (AUM) annually. For instance, if your portfolio is worth 8 billion, you can anticipate paying fees of between 8 Lakhs and 16 Lakhs per year.

Portfolio managers charge greater fees than other types of financial consultants, but if they can help you increase your wealth and achieve your financial objectives, their services may be well worth the added expense.

How to Maximize Financial Investment Portfolio?

The secret to a successful overall portfolio is diversification. It’s crucial to realize that diversification does not imply an equal distribution of your portfolio’s holdings throughout all asset types.

How Portfolio Management Services Works?

Experienced Fund Managers

Establishing a long-term financial goal and working toward it methodically through savings and investment can give you a stronger sense of direction and drive.

Diversified Portfolio

You are likely to be more disciplined if you are investing according to a plan.

Expert Financial Valuations

To achieve successful integration, we identify its investment objectives and then develop a coordinated plan that takes into account all of the company’s investment activities.

Risk Analysis

The goal of diversification is to reduce risk and improve returns by investing in a variety of assets that are not perfectly correlated.

Frequently Asked Questions

The correct way to consult with the best portfolio management services in India will vary depending on your circumstances and goals. You can search for them online and talk to them directly. Or, You can take help from your friends for advice.

Financial portfolio management is the process of overseeing and managing a person or organization’s investments and assets. This can encompass everything from developing investment strategies and picking stocks, to monitoring performance and managing risk.

An investment portfolio manager is responsible for managing a portfolio of investments for a client. This includes making decisions about what investments to buy and sell when to buy and sell them, and how to do the overall investment and portfolio management.

To plan your mutual fund portfolio, you will need to consider your investment goals, risk tolerance, and time horizon. You will also need to choose the right mix of asset classes for your portfolio. Or, you can take direct help from a mutual fund portfolio management company.

Wealth Manager typically offers a variety of services, such as portfolio management, estate, and retirement planning, and tax services, and they advise private high-net-worth individuals and affluent families on how to invest their portfolios and plan their finances to meet their financial goals. You can search for a wealth manager near me for professional help.

Most wealth management advisors offer comprehensive financial planning services as part of their overall offerings. While there may be some firms that focus exclusively on wealth management, most financial planners also provide wealth management services. The main difference between the two is that wealth advisors provide a more comprehensive suite of services than portfolio planners.

A wealth management consultant provides individuals and families with comprehensive services to help them plan for and achieve their financial goals. This may include investment management, estate planning, tax advice, and insurance planning.

An investment management company, also known as an asset management company or an investment firm, is a company that manages and invests funds on behalf of its clients. These clients can be individuals, corporations, pension funds, insurance companies, or other entities looking to grow their wealth or achieve specific financial goals.

The best PMS in India is the one that best meets your investment needs and objectives. To find the portfolio advisory services India that are right for you, first consider your investment goals and then research the various AMCs available. Once you have narrowed down your choices it becomes easy to filter out the best and most affordable among them.

If you’re unsure of how to manage your finances, make investments for the future, or take care of your family, hiring the best investment advisor in India is a wise investment.

Our Fund Manager

Komal is a highly qualified and experienced finance professional who has been working with The Gainers for over three years. She has an MBA in Finance and Operations from IMT Ghaziabad, one of the most reputed management institutes in India. She also has a Masters in Commerce and CA(Inter) qualifications.

As a part of The Gainers team, Komal is responsible for enhancing the customer experience and ensuring that their financial goals are met. She has a deep understanding of the banking, insurance, NBFC and education sectors, and has worked as a branch manager in a leading private sector bank before joining The Gainers. She has a proven track record of delivering excellent financial results and developing talent in her team.

Komal has also completed the CFGP Advanced Level Program, which is a comprehensive and rigorous course that covers both theoretical and practical aspects of financial planning. She has demonstrated her expertise and skills in various areas such as investment planning, retirement planning, tax planning, estate planning and risk management. She is committed to providing ethical and professional advice to her clients and helping them achieve their financial dreams.