Portfolio Management Services (PMS) are a type of investment service where qualified and experienced portfolio managers manage equity portfolios on behalf of clients, instead of clients managing themselves. PMS can offer customized and personalized investment solutions to suit the needs and goals of different investors. PMS can also be more aggressive and flexible than mutual funds, as they have fewer regulatory restrictions and can take advantage of market opportunities.

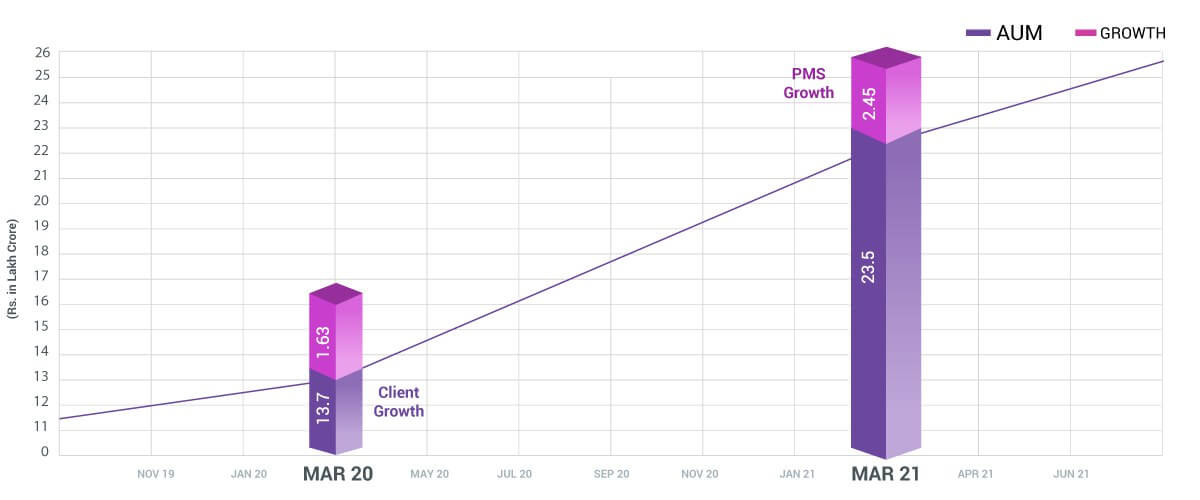

PMS are becoming increasingly popular in India, as more investors are looking for professional guidance and higher returns in the volatile and complex equity market. According to SEBI data, the assets under management (AUM) of PMS in India grew from Rs 13.7 lakh crore in March 2020 to Rs 23.5 lakh crore in March 2021, a growth of 71%. The number of PMS clients also increased from 1.63 lakh to 2.45 lakh in the same period, a growth of 50%.

There are several factors that are driving the growth of Portfolio Management Services in India, such as:

- The rise of high-net-worth individuals (HNIs) and ultra HNIs, who have a higher risk appetite and seek more customized and diversified investment options.

- The underperformance of mutual funds in the past few years, especially in the mid-cap and small-cap segments, which have eroded investor confidence and returns.

- The availability of a wide range of PMS strategies and products, catering to various themes, sectors, market caps, styles, and risk profiles.

- The improvement in the transparency and disclosure norms for PMS by SEBI, which have enhanced investor awareness and protection.

- The emergence of online platforms and portals that provide easy access and comparison of various PMS schemes and performance.

However, PMS also come with certain challenges and risks that investors should be aware of, such as:

- The high minimum investment amount of Rs 50 lakh, which limits the accessibility and affordability of PMS for many investors.

- The high fees and charges involved in PMS, which can eat into the returns and reduce the net profit for investors.

- The lack of standardization and uniformity in the reporting and benchmarking of PMS performance, which can make it difficult to compare and evaluate different PMS schemes.

- The possibility of higher volatility and concentration risk in PMS portfolios, as they may have lower diversification and higher exposure to certain stocks or sectors.

- The dependence on the skill and expertise of the portfolio manager, who may not always deliver consistent or superior returns.

Get Free Portfolio Risk Analysis

Therefore, investors who are interested in portfolio management services in India should do their due diligence before investing, such as:

- Assessing their risk profile, investment horizon, return expectations, and financial goals.

- Researching the background, track record, reputation, and credentials of the portfolio manager and the PMS provider.

- Understanding the investment philosophy, strategy, process, portfolio composition, risk management, performance history, fee’s structure, and exit options of the PMS scheme.

- Comparing different PMS schemes across various parameters and platforms and seeking expert advice if needed.

- Monitoring the performance and portfolio activity of the PMS scheme on a regular basis.

PMS can be a rewarding investment option for investors who have a high-risk appetite, a long-term horizon, a large corpus, and a desire for customized and professional portfolio management. However, investors should also be aware of the potential pitfalls and challenges involved in PMS investing and make informed and prudent decisions accordingly.